Blog post -

Article: Minimum wage hikes struggle to offset inflation

By Christine Aumayr-Pintar and Carlos Vacas-Soriano

As the EU economy advanced its recovery following the pandemic, the high rate of inflation throughout 2022 meant that wage setting actors made their decisions under a cloud of uncertainty. While nominal increases in statutory minimum wages reached an all-time high, minimum wage workers in most countries saw their purchasing power decline or just about compensated at the beginning of 2023, based on preliminary harmonised inflation figures. With inflation expected to persist, a further depreciation of minimum wages in real terms can be expected in most Member States, as only a few foresee additional increases in 2023.

Large statutory minimum wage increases in 2023 in nominal terms

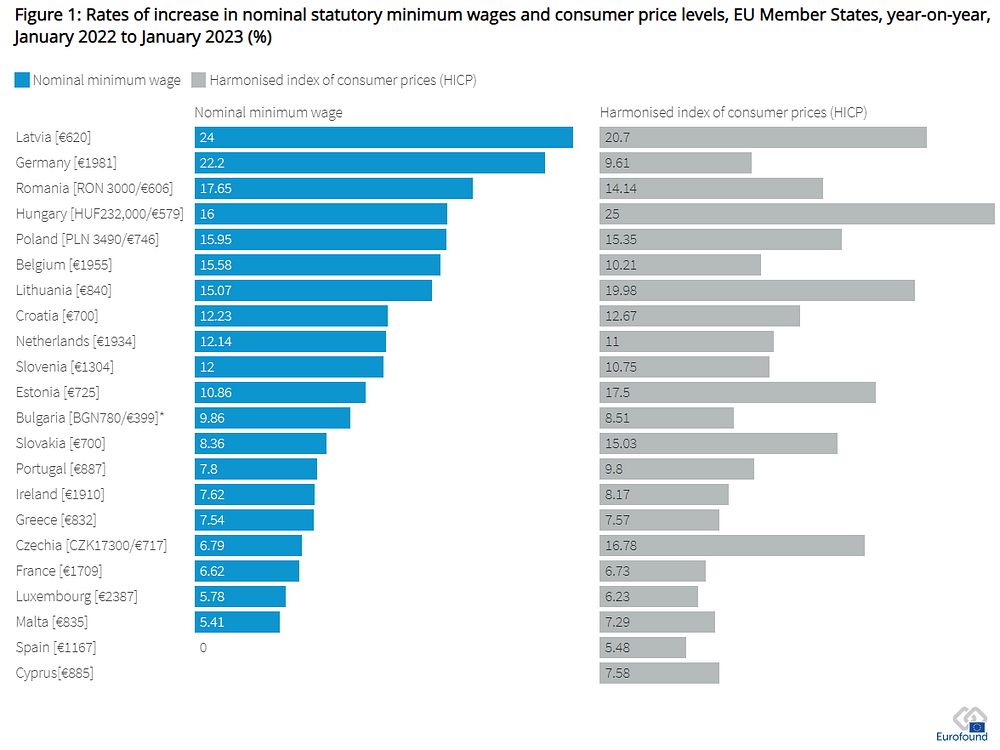

Minimum wage setting for 2023 took place in the shadow of high levels of inflation, which hit EU Member States harshly in 2022. To protect the earnings of the lowest paid employees, most governments have boosted minimum wages to a much larger extent than last year. Figure 1 shows the increases in nominal rates between January 2022 and January 2023 in the Member States that have a statutory minimum wage. The main developments are summarised below.

- Nominal rates have increased across most Member States, ranging from more than 20% in Germany and Latvia to over 5% in France, Luxembourg and Malta. The only countries where nominal rates have not increased in January 2023 are Spain, where negotiations are still ongoing, and Cyprus, where a statutory minimum wage has just been introduced.

- Increases are much higher than last year (and incomparably higher than previous years). Across the Member States (excluding Spain), the average nominal increase in 2023 is 12%, compared with around 6% last year (between January 2021 and January 2022). The median increase in 2023 is 11% so far, more than double the 5% of the previous year.

- Minimum wages have generally risen more among central and eastern European countries, marking a continuation of upward EU convergence over many years. Latvia hiked its minimum wage by almost 25% in 2023 (after having frozen it since January 2021). In addition, out of the 13 countries with the biggest increases, 10 are Member States that joined the EU after 2004. Eight register increases above 10%, while the other two, Bulgaria and Slovakia, come close to that figure.

- Among the pre-2004 Member States, minimum wages have generally risen more modestly, with increases of 5–8%. The exceptions are Belgium, Germany and the Netherlands. Germany (22%) and the Netherlands (12%) have set higher increases largely due to a deliberate policy intervention aimed at improving minimum wage levels. In Belgium, the 16% increase arises mainly from the implementation of several automatic indexation mechanisms from January 20

Notes: Monthly minimum wage levels in January 2023 are reported beside the country labels; in Greece, Portugal, Slovenia and Spain, the amounts have been converted to reflect 12 payments. The percentage increases in gross statutory minimum wages are calculated between January 2022 and January 2023 in national currencies, with the exception of Bulgaria, where the rate was increased in April 2022 instead of January. As of January 2023, negotiations are ongoing to set the new statutory rate for 2023 in Spain. Cyprus has just introduced a statutory rate in 2023 (above the previously existing occupational rates). Inflation is the percentage increase in price levels (according to the Harmonised Index of Consumer Prices) and refers to year-on-year changes for the latest month for which data are available (December 2021 to December 2022, except for Bulgaria, where March to December 2022 is used).

Source: Eurofound, Network of Eurofound Correspondents

Not enough to significantly lift purchasing power

Despite the abnormally large increases for 2023, the obvious question emerges: will they be enough to improve the purchasing capacity of minimum wage earners? For many countries, the answer is no (as the inflation rates in Figure 1 suggest). The data must be interpreted with care, since a definitive answer will be possible only when inflation data for January 2023 become available. Moreover, it is important to bear in mind that the social partners and governments across the Member States have used national measures of inflation (which deviate from the harmonised ones used here) as a reference for their discussions, which took place at a time when the inflation data may have been different.

It is clear from the latest available data that inflation is strongly eroding the gains in nominal minimum wages described above. In a majority of countries, the resulting picture is one where the purchasing power of minimum wages is likely to have been broadly restored between January 2022 and January 2023, because the increases in nominal rates have been roughly comparable to inflation rates. Nevertheless, some countries did not achieve the expected stability in the level of minimum wages in real terms.

On the positive side, minimum wage earners will have benefited from significant purchasing power gains in Germany and Belgium (and Latvia and Romania to a lesser extent). On the negative side, the nominal hikes in January 2023 may not be enough to avoid significant falls in purchasing power among minimum wage earners in some central and eastern European countries affected by high inflation rates (Czechia, Hungary, Slovakia, Estonia and Lithuania).

It is important to bear in mind that this assessment of the purchasing power of minimum wages considers only the extent to which the new nominal rates set in January 2023 have been able to offset the impact of price growth up to that point. But, given the likely persistence of inflation as the year progresses, a further deterioration in minimum wages in real terms is to be expected across the Member States, unless further increases in nominal rates take place.

Setting of minimum wages in times of inflation

The rate of inflation was considered in the setting of the new minimum wage levels, but it was not the only factor taken into account, nor the predominant one, as might have been expected, given the high and unprecedented rate not seen in recent decades. There are several reasons for this.

- Some countries have clear and binding criteria in their legislation for the updating of the minimum wage, and inflation is just one of several criteria or only indirectly present, or it is not clear how inflation features in the process (for example in Bulgaria, Croatia, Ireland, Latvia and Slovenia).

- Other countries focused on the medium-term development of the minimum wage, in line with the reference values mentioned in the directive on adequate minimum wages (for example Ireland, Germany, the Netherlands, Portugal and Spain).

- Portugal explicitly stated that its interpretation of inflation was temporary, so for the time being no permanent uprating of the minimum wage was sought.

- Most governments introduced other measures to support citizens (predominantly the low paid, but not exclusively) to cope with the increased cost of living.

Overall, the responses of most minimum wage setters were in line with their regular model of minimum wage setting, and no substantial modifications to these systems were made, except for some notable adaptations, which are discussed in the next sections.

- Database: EU PolicyWatch – Responses to inflation

Single increases in January 2023 continue to be the norm

Most Member States so far have opted for a single increase to be given in January. In several Member States (Bulgaria, Croatia, Czechia, Latvia, Lithuania and Slovenia), this decision was taken by government following non-agreement between the social partners. But there are two cases where bipartite agreements were reached (Estonia and Slovakia) and one case of a tripartite agreement (Portugal). Estonian trade unions initially argued for a second increase but reached agreement with the employers on a single increase quickly. Likewise, the negotiation in Slovakia was considered smooth, and the rate agreed exceeds that which would have been mandated by law. The agreement in Portugal related to wage increases in general but set minimum wage increases on a path to reach €900 by 2026.

This is similar to 2022, when most countries upgraded their nominal rates in January 2022 and did not increase them further despite inflation eroding the purchasing power of wages. Only a few countries implemented further increases after January 2022, either because of indexation mechanisms (Belgium, France and Luxembourg), mid-year planned increases (Germany and the Netherlands) or ad hoc interventions (Germany, Greece and the Netherlands).

Now that the new rates for 2023 have been set, it remains to be seen whether inflationary pressures result in further increases in the coming year across the Member States.

Automatic indexation kicked-in in three Member States

Three Member States – Belgium, France and Luxembourg – have automatic indexation mechanisms to ensure that statutory minimum wages are updated in line with inflation. Belgium had a series of six increases after January 2022, five of them due to indexation, as the ‘smoothed health index’ [1] increased by more than 2% several times during the year. The latest increases were made in November and December, and no further increase was applied in January. In France, two additional ad hoc increases were made based on the regular indexation formula in 2022. Luxembourg applied one additional increase as a result of the automatic indexation but postponed a second increase by 12 months, based on tripartite agreement, arguing that this would ensure predictability for companies. For January 2023, the statutory minimum wage was nevertheless uprated in line with actual wage development, adhering to the regular biannual practice.

In addition, Malta adjusted the statutory minimum wage in line with its regular cost-of-living allowance mechanism (COLA), and while the ongoing debate on reforming this mechanism continued, the status quo remained. However, an additional COLA mechanism has been introduced for vulnerable households, which foresees an extra benefit to be paid, depending on developments in inflation. Poland has a clause in its minimum wage legislation that obliges the government to raise the minimum wage within a year if the (projected) annual inflation rate exceeds 5%. This clause was applied in 2023, with a second increase foreseen for July 2023.

Extraordinary ad hoc increases

Three countries – Germany, Greece and the Netherlands – deviated in 2022 from their regular minimum wage setting practice and applied special ad hoc increases. In Germany, in addition to the regular increase for July 2022 set by the Minimum Wage Commission, another increase to €12 was made in October 2022 by the government. The understanding is that the Minimum Wage Commission will continue the regular process of minimum wage setting according to its rules in 2023. In Greece, an ad hoc increase in May 2022 was a direct response to inflation.

The Netherlands, for the first time since the introduction of a minimum wage in 1969, deviated from its standard practice of uprating the statutory minimum wage in line with collectively agreed wages. It opted for a special increase, beyond the regularly applied formula, resulting in an increase of 10.15% since the last increase in July 2022 (or 12.1% since January 2022). Initially, the idea was to implement an extraordinary increase (of 7.5%) over three years up to 2025. However, in light of inflation, the government decided to implement the full amount in January 2023.

Extra increase considered for 2023, depending on inflation

In Hungary, the peak-level social partners came to an agreement within the tripartite social dialogue body (the Permanent Consultative Forum of the Private Sector and the Government, VKF). The agreement sets a first rise in January, with an additional clause to review the increase mid-year if inflation increases to 18% and GDP growth is positive. In addition, the government agreed not to increase the social contribution tax on wages. In this regard, the Hungarian solution is unique, as no other countries made a similar pre-agreement on a review.

Other Member States that discussed an extra increase over the course of 2022 are Ireland, Lithuania and Slovenia. In Lithuania, the social partners considered the option of a two-step increase, with a possible review ahead of the second revision, although no agreement was reached. In Ireland, the trade union members of the Low Pay Commission (LPC) argued in their minority report for a two-step increase in 2023, but a decision was made not to undertake such a double increase. Nevertheless, the LPC will continue the practice from last year of reviewing the level of increase retrospectively once final data are available, and it could adapt the 2024 rate in line with developments in 2023. Such a review was carried out in 2022, and the planned increase for January 2023 was augmented. The Slovenian government proposed a two-stage increase, with one in November 2022, to align the minimum wage with the increase in the minimum cost of living, and a second in January, to align it with the growth in consumer prices. While trade unions were supportive, employers dismissed this option, arguing for the need of business to have predictability of wage costs.

Conclusions

The high nominal increases in minimum wages between January 2022 and January 2023 will not for the most part translate into significant increases in real terms. Even if rising inflation slows in 2023, [2] it is likely to remain well above the price stability target of 2% per annum, and a further depreciation in the purchasing power of wages can be expected, except where they are increased within the year. The wage setting regimes did not make any major changes in their practices in light of the inflationary pressures. Only one of the Member States with an automatic indexation mechanism (Luxembourg) has not fully applied the increase calculated by the mechanism. In the other Member States, it was applied as usual. Debates about changing this mechanism – which pre-date the inflationary context – continued. Unions in most countries asked for inflation to be taken into account or to be more central to the negotiation, some calling for more automated mechanisms, while employers argued for caution and maintaining predictable updates so as not to overload labour costs.

Overall, inflation continued to be only one factor among many other economic and social factors informing the increases for 2023. As governments across the EU compensated citizens partially for increased energy prices, the pressure on the cost of living fell somewhat. In addition, governments changed the rules regarding the taxation or the social security contributions of minimum wages, thereby supporting workers’ take-home pay indirectly.

References:

- A national inflation rate based on consumer prices, which does not include alcoholic beverages, tobacco products and motor fuels.

- In December 2022, the European Central Bank projected an annual average rate of 6.3% for the euro zone in 2023, down from 8.4% in 2022, and predicts a return to ‘normal’ by 2025 (with 2.3%).

More information: