News -

Europe’s pre-existing household debt condition likely to be exacerbated by virus crisis

The coronavirus (COVID-19) crisis, and the economic and social challenges that it entails, comes at a time when many vulnerable groups in Europe were already exposed to debt and arrears, according to Eurofound’s new research on household indebtedness. The pandemic could also exacerbate an already divergent situation in the EU, with some countries in southern and eastern Europe disproportionately affected by debt, arrears and risk of poverty.

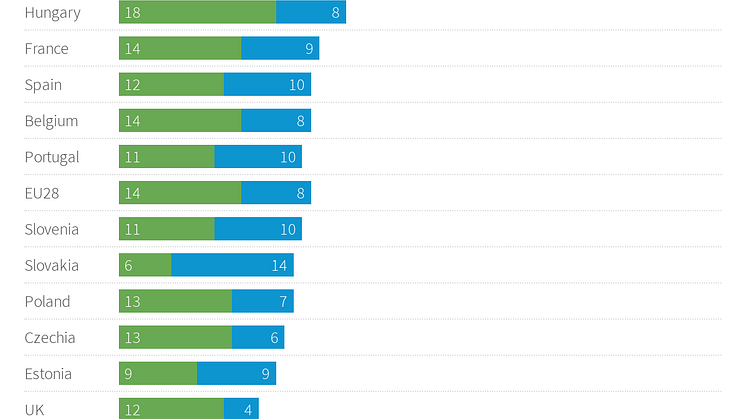

The new report, based on an analysis of the 2016 European Quality of Life Survey, shows that debt and risk of poverty were disproportionately problematic in southern and eastern Europe. This was most notably the situation in Greece, where over half of those surveyed reported being in arrears; in total, 52% said they were in arrears in rent or mortgages, consumer credit, loans from family or friends, or utility and phone bills. At 36%, Croatia had the second highest proportion that reported being in arrears, and in Bulgaria 31% reported being in arrears. Across the EU and the United Kingdom, 14% reported being in arrears, with wide variance between Member States. In Sweden just 4% reported being in arrears. These figures do not capture people with high levels of indebtedness who do not have arrears or immediate difficulties making ends meet – for whom this crisis can turn their indebtedness instantly into over-indebtedness.

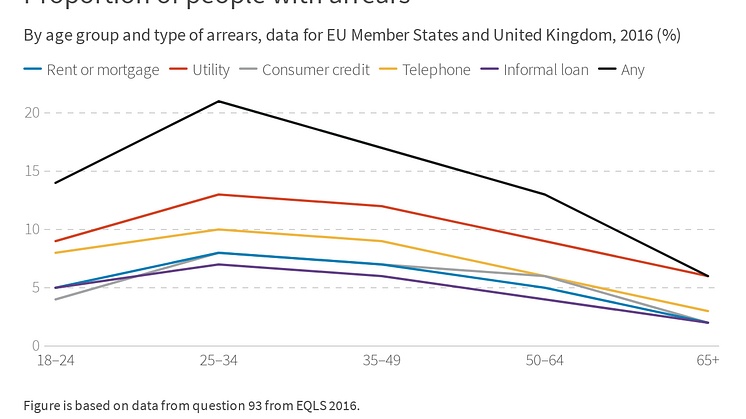

Eurofound’s research emphasises that over-indebtedness can spiral into greater financial problems, and takes its toll on already strained mental well-being for sections of the population. For example, from 2017 to 2018 there was an increase of arrears among single parents at risk of poverty. This reinforces research from Eurofound’s previous report on Household composition and well-being, which highlighted risk of poverty and social exclusion among single parents, as well as single-person households.

After the global financial crisis in 2007, many countries strengthened their institutional responses to over-indebtedness. Debt advisory services became more widely available and accessible in a number of Member States. However, even in countries with well-established services, people experienced problems accessing them. The new reality in which Europe finds itself risks deepening this problem further. Immediate actions being taken in a number of Member States on rent, mortgage and utility payments will give many households and businesses breathing space, but the issue will need to be looked at in a more structured way in the long-term. There should also be a specific regard for the self-employed, whose household and business finances are in practice often hard to separate out fully, and business debts can cause private over-indebtedness.

With regards to measures that can contribute to preventing over-indebtedness, credit regulation, financial education and social protection are all areas in which the EU plays an important role – with adequate social protection being particularly important in times of economic shocks. On debt settlement procedures, the report shows that there is a case for EU action to ensure their availability, enable countries to learn from practices elsewhere, avoid access problems, and guarantee a level of well-being for people undergoing such procedures – including some level of protection of their home.

Speaking about the findings, Juan Menéndez-Valdés, Eurofound Executive Director, said “This report clearly shows that over-indebtedness was already an issue for many people in Europe. The new situation, severely impacting individual earnings and household debt, as well as potentially the proportion of people in arrears, needs to be urgently addressed in a coordinated way to avoid deepening negative consequences for Europe’s economy and broader society.”

Get the data here

Read more:

- European Commission: Coronavirus response

- Eurofound: Addressing household over-indebtedness

- Eurofound: Household composition and well-being

- Datawrapper: Proportion of people at risk of over-indebtedness